What is the “American Dream”?

According to Wikipedia, “the American Dream is a national ethos of the United States, the set of ideals (democracy, rights, liberty, opportunity and equality) in which freedom includes the opportunity for prosperity and success, as well as an upward social mobility for the family and children, achieved through hard work in a society with few barriers. In the definition of the “American Dream” by James Truslow Adams in 1931, "life should be better and richer and fuller for everyone, with opportunity for each according to ability or achievement" regardless of social class or circumstances of birth. The American Dream is rooted in the Declaration of Independence, which proclaims that "all men are created equal" with the right to "life, liberty and the pursuit of happiness."

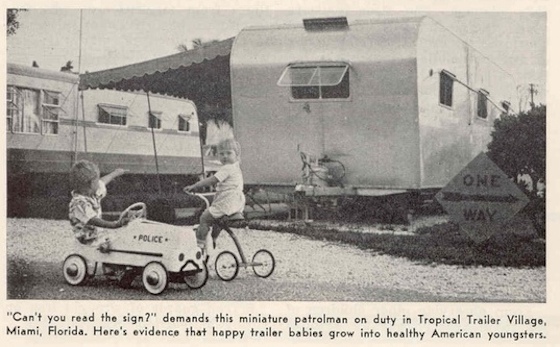

One big part of the “American Dream” has always been the ability to be a homeowner. When you ask the average American “what’s the American Dream?” they will always answer “owning your own home”. That’s been reflected in American culture for over a hundred years, even in small items like the piggy bank from the 1930s – shown above – that references that saving for your home down-payment is your #1 priority. So how has that opinion changed over time, and where is it heading?

Rates of home ownership increased for decades

The rate of home ownership in 1960 was 65.2%. It increased steadily to 69% by 2004 – the peak year of home ownership in American history. At that time, it seemed as though the rate would continuously inch upward until the ownership rate was ultimately nearly 100% -- with the only renters being those who were saving up their down-payment for the home purchase.

And consider the financial performance during that period

In 1960, the average home in the U.S. cost $11,900. Inflation adjusted, that amount in 1960 is the same as $102,737 today. Yet the average home cost today in the U.S. is nearly $200,000, which is twice that of the rate of inflation. That would rank single-family homes as one of the most successful investment models of the 20th century. So were home buyers really chasing the goal of owning their residence, or were they merely following a traditional investment path?

But now things have changed

However, since the single-family home mortgage bubble burst and the Great Recession of 2007 began, the current rate of home ownership is 64.2%, which was lower than 1960. This would have been considered impossible to “American Dream” purists. But, of course, those who coined the phrase “American Dream” were born in the 19th century.

Unlocking the driver to home ownership

So the key question is: how much of home ownership is based on the desire to not be a renter, and how much of it is simply an investment strategy? And is the rate of home ownership declining simply because Americans are no longer convinced that homes are a great investment based on the financial performance and they prefer the freedom of renting over ownership? In that case, will this trajectory change in the years ahead?

What the “American Dream” of the future may look like

If younger generations do not share the “American Dream” and fail to believe in the investment strategy of a stick-built house or the necessity to own one simply because that’s what they’ve been told, then what happens? That’s an issue that builders and realtors across America are beginning to ponder. As the Baby Boomers (those born between 1946 and 1964) retire at the rate of 10,000 per day and downsize, who will be buying their homes? Will it be the end user, or companies that specifically buy these homes merely as rental property?

The impact of this theory on mobile home price appreciation arguments

One constant complaint by many people is that mobile homes do not appreciate – that they follow the same path of an automobile that declines in value annually because of age. But this complaint is only valid if you believe that home ownership is simply about the investment model. At the other end of the spectrum, you could also argue that the mobile home owner is smarter than the single family investor, since they spend a far lower amount monthly on their housing, and can invest the difference in other things that gain in value, or hold value, better than a dwelling.

The future is all about flexibility

Mobile home parks offer the ultimate in flexibility. The resident rents the land and has an investment as low as $2,000 or so in a used home up to $40,000 in a new one (about 80% to 99% less than stick-built home prices). And they can still be a homeowner without gambling on the single-family home business model. This also hedges their risk on mobility, as the stick-built owner is burdened by selling their gigantic investment that can sometimes take years, while the mobile home owner has a much smaller risk and a more robust market of those needing affordable housing. While most Americans have virtually all of their net worth invested in their home, mobile home owners do not have all their eggs in one basket.

Conclusion

Home ownership and price appreciation are rapidly evolving. Mobile home parks strike a good middle ground that offers low cost and greater mobility and this is clearly resonating well with the new America as demand has never been higher.