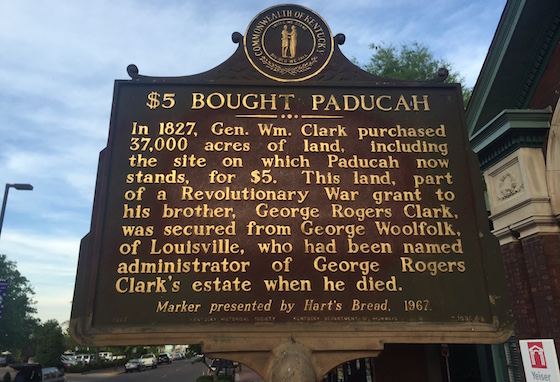

The city of Paducah, Kentucky, population 25,000, was originally purchased for $5. Today, that sounds like a bargain price, but you still might have been better off buying a different chunk of land in 1800. Remember, after all, that Manhattan Island was originally just farm land. So what goes into a great mobile home park location?

Metro population size

Let’s start with population size. Don’t worry about the city itself that the park is located in. That could be just a small suburb. The key gauge is the “metro” population. We prefer metro areas that are 100,000 and up. At that size of population, you have a very diversified economy with a large number of employers and a very aggressive chamber of commerce. You have every big box retailer, every type of franchised restaurant, a large hospital, a large school district – all types of opportunities for jobs. Without jobs there’s no income, and no income means no rent can be paid.

Good school district or “heart of the city”

We have found that there are two basic types of mobile home park locations that work well: 1) a great school district and 2) an urban location in the middle of town. Why do these work? Because there are two different types of mobile home park residents: 1) those that can’t afford a stick-built home but want the same things that we all want, such as good schools for kids, low crime, and solid neighbors and 2) those that want to live in the heart of the action on a limited budget.

Diverse job market

Not all metro area economies are created equal. Some are based on one huge employer who represents 80% of all jobs. These type of markets can wither and die in the event that the major employer moves, shuts down, or simply engages in layoffs. A good market is one in which there is an even diversity among employers, with no single employer having complete dominance. In addition, a good market has key employers that are “recession-resistant”, such as hospitals, colleges, school districts, government jobs – job that are immune to layoffs regardless of the state of the national and state economy.

Median home price

Mobile home parks represent “affordable housing”. In order to be “affordable” you have to have “contrast” with higher home prices. That’s why we like median home prices to be around $100,000 or more. However, you can still have a successful mobile home park at lower median home rates. The danger zone is around $50,000 or so. At that price, the mortgage payment would be lower than the lot rent in many parks. Of course, mobile home park customers rarely have the credit rating or down payment to actually buy a house.

Apartment rents

Apartments are the main competition to mobile home parks. As a result, you want to have a price advantage. Average two-bedroom apartment rents of $700 or so is a healthy market. $300 apartment rents are not. We like to have average apartment rents that are twice our lot rent. Not that we need that type of price advantage; most of our residents prefer mobile homes over apartments even if they were the same cost, due to 1) having no neighbors knocking on ceilings or walls 2) having a yard 3) being able to park by your front door 4) having the ability to be a homeowner and 5) having a stable community of like-minded individuals.

Secure from extreme weather events

Regardless of whether or not you believe in global warming, the truth is that weather is becoming more severe every year. This can have a significant impact in many regions. The two most obvious are 1) hurricane areas and 2) drought. In most of America, more severe weather can be a nuisance. But in other areas, it can mean financial collapse for a mobile home park.

Conclusion

Sure, $5 for Paducah, Kentucky was a good deal. But you’re unlikely to see that pricing again. As a result, you need to make sure that you are buying a good mobile home park location for the long term.