The NCC is the “fanciest” event of the year, and this year’s conference was no exception. The setting was the Drake Hotel – one of the best hotels on the “Miracle Mile”. This always strikes me as strange. We’re an industry devoted to affordable housing, yet we hold this event in one of the upscale settings in the U.S. However, that’s also a huge draw and that’s why there are around 300 community owners, bankers, appraisers and brokers in attendance – and certainly nobody complains about the venue. So here’s our basic rundown of the event.

Attendance

Impressive. It was up over last year – and last year was pretty good. I would guess about 300 industry people were present. It ranged from folks that owned one park to the largest REITs. It included most of the best-known industry banks and brokers, and there were also some of the those private equity groups we keep telling you about sneaking around. Overall, I think this event is here to stay and will probably increase significantly in the years ahead.

Speakers

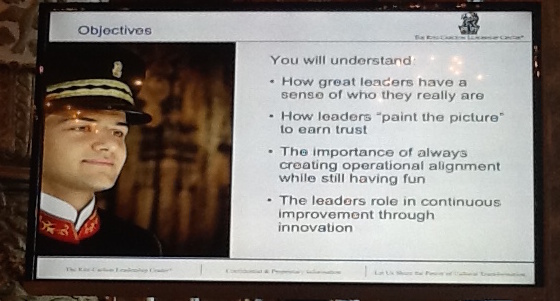

The majority of the time – around six hours – was devoted to one speaker: the Ritz Carlton. The topics were basically how to give superior customer service and how to be a superior leader. Since most people spend the event networking and having little one-off meetings in the hallways, few people really pay a lot of attention to the speeches. But this one was unusual as it did not seem to fit the industry at all. While there were a few items that people remarked on later like the fact that the Ritz gives each employee a $2,000 per day discretionary budget to make sure that every customer is happy (can you imagine how fast you would go bankrupt in the mobile home park business if you actually adopted a similar concept), most attendees echoed the fact that we needed something that fit the industry better as a future topic. Of course, most people just used the speeches as background noise while on the phone or emailing, so you could have probably played a continuous loop CD and nobody would have noticed. The in-between “focus groups” had much more relevant content, and probably the most memorable comment came from Dan Weissman (who shared the Bloomberg article with us earlier in the year) who, when asked what the greatest threats to the industry are commented “global warming and class-action lawsuits”.

Overheard at Dinner

Perhaps the most anticipated part of the NCC event is the dinner. Last year it was on a dinner ship in the harbor. This year, on the 96th floor of the John Hancock Building. It’s a once-a-year mixer in which old friends re-connect, old enemies are avoided, and new contacts are made. My dinner was memorable in that I sat next to Jim Clayton, and had a chance to get his insights into the future of the industry (one of my favorite topics). For those who have never met Jim, he is a 100% great guy who really understands the business as he devoted his working life to it. He’s also a smart businessman who sold the business to Warren Buffet in 2003 before the real industry turn down took effect. I learned that his first home was a 12’ x 44’ and was white with light blue trim, and that simple home grew into an industry leader in manufacturing and financing. I also learned that what really took the manufacturing business down was not the product or the customer, but the financing fiasco brought on by Greentree Financial in the late 1990s. Prior to that moment, mobile homes were sold on 5 to 10 year amortizations, and required 20% or so down payment. As a result, the lender was well protected against a loss if the homeowner went into default, and the homeowner had much more to lose if they considered letting the home go back. The advent of the zero-down, 30 year mortgage on mobile homes around 1999 spelled doom, as what had been a well -balanced relationship with relatively low losses suddenly hemorrhaged into a debacle that took many lenders under. It was kind of like taking a well-balanced terrarium and putting a shot of bleach into it. I’ll have a complete rundown of topics from the event in my Journal article coming out soon.

Overall Review

My hat is again off to Jenny Hodge at MHI, who put the event together. It ran smoothly and was well-attended. It’s still the only event that you can find so many industry people wearing suits – you might mistake the thing for a buyer’s convention for the suit department at Neiman Marcus. Will I be back next year? Absolutely.