As I discuss prospective deals with clients, lenders and equity groups, there is a common theme emerging these days. Trepidation creeps into people’s voices as the whisper softly and furtively the words “real estate bubble”. Everyone is afraid of it happening again and in being a victim to it. No more so than in the multifamily sector.

Multifamily has had an amazing run since the downturn. The subprime mortgage crisis not only created more renters in the short term, but also made many re-think the American dream of homeownership and opt for rental real estate as a long term solution to their housing needs. This is further exacerbated by the amount of Millennials coming out of college with massive student loans who are unable to qualify for a mortgage until much later into their careers. Long story short, the increase in demand for rental housing has maybe never been stronger.

However, like all things that increase rapidly in value, there is a race to provide more and more product and capitalize on it. While demand has been very high, development has started to catch up. In cities like Washington DC and Denver, higher

end multifamily projects are starting to have to use concessions to attract renters in order to get the projected rents that were put into their proformas. Those discounts drive down net effective rents which, in turn, hamper cash flows. For properties that are already trading at record low cap rates, this starts to really squeeze the yields on these assets.

Due to this, investors have been going “down the chain” to lower asset

classes in multifamily. First, they would put a little money into a B-class

apartment complex and spruce it up to try and sneak right under the

A-class rents. Then, after cap rates on those assets dropped, investors

started targeting C-class assets for larger turnarounds. Both of these

movements, inclusive of the rehab and rent raising, has left a large swath of the population in need of an affordable solution to their housing needs.

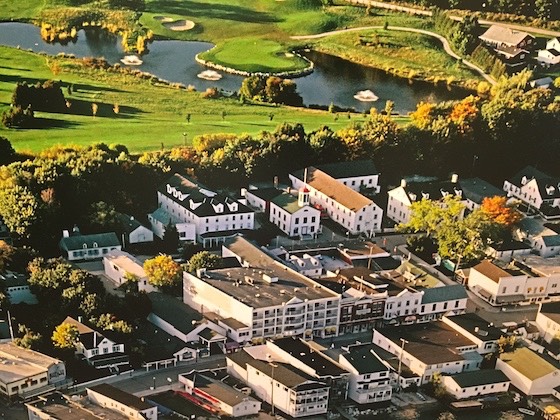

Enter Manufactured Housing as a solution to both the need for affordable housing product and investment yield. Manufactured Housing Communities (or MHCs) have had a pretty bad rap over the years. From the cinematic exploits of “Trailer Park Boys” to the drama of a mid-western tornado destroying a mobile home park on the news, these properties tend to be looked down upon pretty regularly. However, the industry has begun to attract a good amount of attention of some of the savviest minds in real estate including Sam Zell (the largest single owner of MHCs) and Warren Buffet (the largest owner of home manufacturing and in community lending).

The advantages to investing in MHCs are many fold. They tend

to cost a fraction per unit to their comparable multifamily

brethren (a B-/C+ apartment project in a market like Denver,

CO would cost upwards of $125,000 per unit, whereas a similar

class of MHC would cost $50,000 for the site and $35,000 for

the home, if it’s needed, for a total per unit cost of $85,000 and

those comparable units would demand the same rental rate)

and they tend to serve families over individuals, making their

tenant base much less transient. Further, the price per square

foot in rental rate is nearly 30% less than apartment pricing with

no adjoining walls and parking spaces at each unit. Lastly, cap

rates for this product type tend to be 100 to 200 basis points higher than the comparable pricing for an apartment unit (for example, an B-class apartment complex in Saint Louis might sell for a 6% cap rate where an MHC of similar grade would sell for a 7% cap).

In addition to the benefits from an investor’s point of view, this product also serves a desperate need for quality affordable housing. There have been numerous studies outlining how bad the problem is, but one of the main studies conducted annually by the Low Income Housing Coalition called the “Out of Reach” report states that, on average, a working class wage earner will pay around 38% of their gross income if they want to rent the average two bedroom apartment. A rental rate is considered “a ordable” for a person if their rent is less than or equal to 30% of their gross wages. In looking at pricing between an MHC with ground rent added to a mortgage on a manufactured home, this tends to be around 15% cheaper than renting the typical two-bedroom apartment in any given city. Since the majority of renters are still people who would be considered “working class”, this represents a major source of housing that is affordable for families who are working in service, construction and transportation industries around the country.

What this all means is that Manufactured Housing is a less expensive alternative to purchasing multifamily real estate, provides a better value proposition for the residents and is an excellent source of housing that is affordable for the average working wage earner over the average apartment. As concerns about the economic cycle persist, the need for affordable housing is something that won’t go away in any economic era. While multifamily product is still a very good asset class, one that may deserve a little more attention would be MHC.

To get ahold of MJ Vukovich for questions or to get the loan process going, email him at [email protected] or call him at 612-335-7740. Let him know Frank & Dave referred you for VIP treatment. And let us know if your loan closes and we will send you a $500 gift card to the home improvement store of your choice to get you started on your park renovations.