I have a number of groups that I'm currently working with who are looking for capital to expand their businesses. As we're working together, it strikes me that there is a flood of optimism in beginning these endeavors in a expanding real estate market. However, the measure of a good capital partner isn't what happens in the days when NOI is growing and investment dollars are readily available, it is what happens when the clouds darken and times are tough that really mark a good partner.

It's with that thought in mind that I attempt to guide my clients. I like to think of the true cost of capital which includes not only the interest rate or rate of return, but also the intangibles. Things like how much control you give up, how the capital structure has an effect on your operations and what happens when times get tough.

For example, a former company that I worked with took on a very large private equity group as its capital partner to do a major expansion. The expansion included buying a number of assets and doing a very large development. The rewards would have been great, but the risks were high as well. During the good times, as the project progressed as scheduled, all was well. But then the development hit some hiccups and progress slowed. Immediately, the capital partner put in additional oversight in the form of someone who had never seen the properties before and had very little experience with the property type. It completely cratered the rest of the project due to over burdensome reporting and approvals. Then it led to a 10 year lawsuit that drained both companies of millions of dollars and threatened to bankrupt the operating company. Long story short, the projected 16%-20% IRR that the operating company thought they were working towards with the investor turned into a major drain that nearly cost them their company.

Does that mean that every private equity company is bad? Of course not. In fact, even the one that my former company worked with isn't full of bad people, but it did end up being a bad match for them. Are these types of experiences limited to just equity? By no means. Many people have had great difficulties with CMBS and bank loans where the properties got in trouble. It doesn't mean these products are bad, it just means you need to count the cost when engaging with these types of capital.

As you are going out for your expansion capital, here are some things to keep in mind as you evaluate each option:

1) How will this impact the way I operate my business? Is there something in the structure that they are asking me to do that will make it difficult to attract customers/tenants or attract good employees that will negatively impact the effectiveness of our operation?

2) If things don't go according to plan, what is going to happen? Have I asked my capital source what they have done when things went wrong in the past? Do they have some references of current partners whom I can reach out to?

3) Can my current operating platform handle the expansion? What types of additional personnel or infrastructure costs will we incur, along with the cost of the additional capital, to grow the company?

4) How much control am I giving up by getting this new capital source? Is there a potential that could have a major impact on my business or business plan? Could that jeopardize the other assets in my portfolio?

5) If I need to get out of this partnership or loan, what are my options? How much will those cost? Does this give me enough flexibility to make sure that I have choices for exiting the project or partnership?

More than anything, it is really valuable to have trusted advisers who are on your side. It's good to get the perspectives of as many people as possible, especially those outside your organization with experience who may be able to see things more clearly than you can.

Expansion is a very exciting prospect for any company and there are a number of capital sources that can help your company achieve its growth goals. However, it is very important to consider the full cost of each capital source as you are going out for additional funds. Not all the costs are readily apparent and those can be the most costly of all.

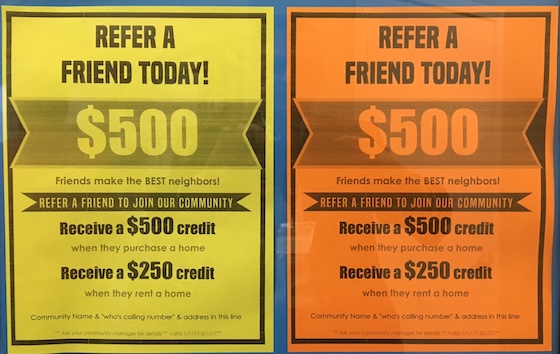

To get ahold of MJ Vukovich for questions or to get the loan process going, email him at [email protected] or call him at 612-335-7740. Let him know Frank & Dave referred you for VIP treatment. And let us know if your loan closes and we will send you a $500 gift card to the home improvement store of your choice to get you started on your park renovations.